Know What Moves.

Make What Sells.

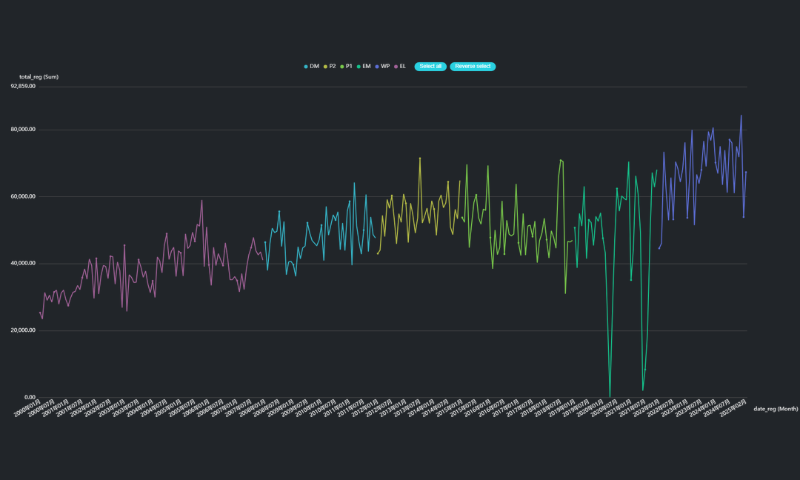

AutoSight 360 is a strategic intelligence platform designed to help automotive parts manufacturers, distributors, and wholesalers master Malaysia’s replacement market. Powered by 25 years of national vehicle registration data and driven by the JarviX advanced analytics engine, AutoSight 360 transforms raw records into powerful insights on which vehicles are on the road, what parts they need, and when.

The Hidden Imbalance:

Sales Outpace Consumption

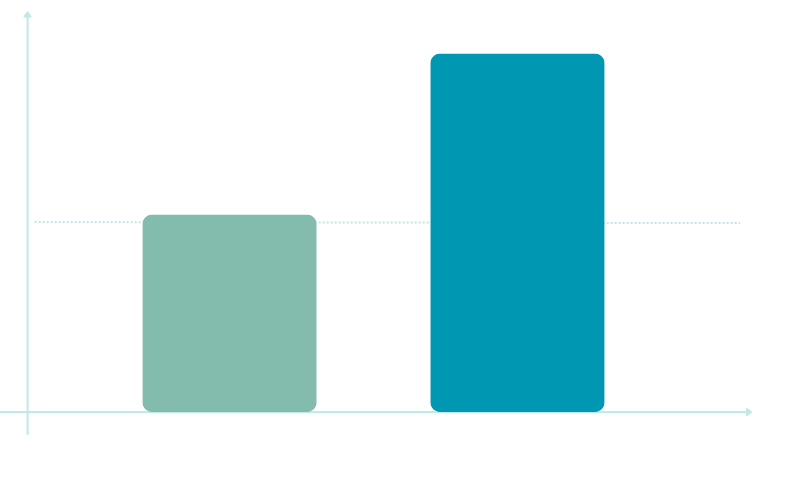

The Malaysian automotive replacement market is undeniably massive — but also inefficient. In 2024 alone, the sale of motor vehicle parts and accessories hit RM60.2 billion, while actual maintenance and repair consumption totalled only RM31.8 billion.

This RM28 billion gap highlights an industry-wide issue: parts are being produced, stocked, and distributed faster than they’re being installed. Much of this surplus is driven by guesswork, overstocking obsolete parts, and a lack of insight into vehicle lifecycle demand.

Who Feels the Pain:

The Strategic Blindspot

Sales Managers

Sales managers are witnessing a steady decline in the performance of previously fast-moving SKUs but are often left without the necessary data to determine why. Is it due to vehicle model obsolescence, shifting consumer preferences, or regional factors? Without a clear understanding of the root cause, sales strategies become reactive rather than proactive, leading to missed opportunities and declining market share.

Product Managers

Product managers face a difficult challenge: forecasting which car models will remain relevant and profitable over the next 3–5 years. In a market where vehicle population is constantly evolving, product development decisions cannot rely on gut feeling or outdated assumptions. Without lifecycle-based demand forecasting, there's a risk of investing in SKUs that won’t align with future vehicle populations, resulting in misaligned product portfolios and lost ROI.

Finance Managers

From the finance perspective, the consequences of misjudged demand are financial deadweight. Significant capital is often locked into inventory for parts that no longer serve active vehicles or have extremely slow turnover. This ties up cash flow, increases holding costs, and puts pressure on working capital efficiency. Finance teams need visibility into which SKUs are overstocked and which are at risk of becoming obsolete before it affects the bottom line.

CEOs and Business Owners

At the executive level, the lack of accurate market alignment presents strategic risk. Without a clear, data-backed view of which vehicle models are growing or declining, leaders may approve product plans, expansion efforts, or investments that are not in sync with market realities. This misalignment hinders long-term competitiveness, slows growth, and creates vulnerability in a market where precision is critical to staying ahead.

Who Feels the Pain:

The Strategic Blindspot

Sales Managers

Sales managers are witnessing a steady decline in the performance of previously fast-moving SKUs but are often left without the necessary data to determine why. Is it due to vehicle model obsolescence, shifting consumer preferences, or regional factors? Without a clear understanding of the root cause, sales strategies become reactive rather than proactive, leading to missed opportunities and declining market share.

Product Managers

Product managers face a difficult challenge: forecasting which car models will remain relevant and profitable over the next 3–5 years. In a market where vehicle population is constantly evolving, product development decisions cannot rely on gut feeling or outdated assumptions. Without lifecycle-based demand forecasting, there's a risk of investing in SKUs that won’t align with future vehicle populations, resulting in misaligned product portfolios and lost ROI.

Finance Managers

From the finance perspective, the consequences of misjudged demand are financial deadweight. Significant capital is often locked into inventory for parts that no longer serve active vehicles or have extremely slow turnover. This ties up cash flow, increases holding costs, and puts pressure on working capital efficiency. Finance teams need visibility into which SKUs are overstocked and which are at risk of becoming obsolete before it affects the bottom line.

CEOs and Business Owners

At the executive level, the lack of accurate market alignment presents strategic risk. Without a clear, data-backed view of which vehicle models are growing or declining, leaders may approve product plans, expansion efforts, or investments that are not in sync with market realities. This misalignment hinders long-term competitiveness, slows growth, and creates vulnerability in a market where precision is critical to staying ahead.

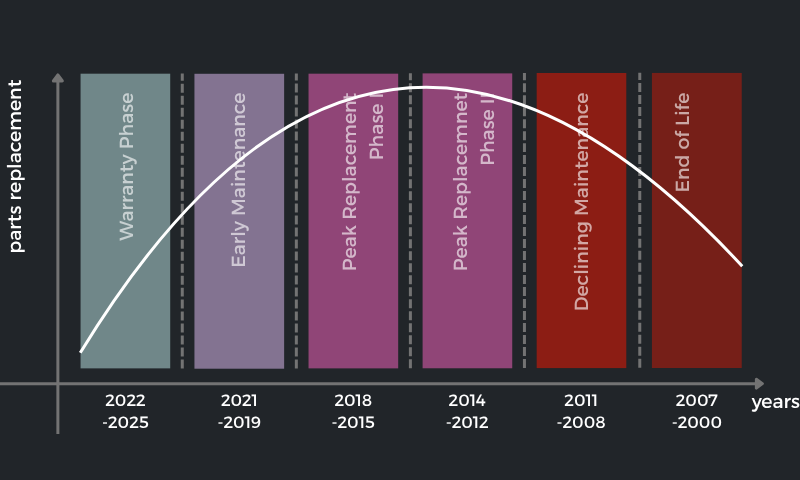

Vehicle Lifecycle:

The Key to Smarter Forecasting

AutoSight 360 maps every vehicle in Malaysia to its current lifecycle phase — Warranty, Early Maintenance, Peak Replacement (I & II), Declining Maintenance, and End-of-Life. This enables manufacturers and distributors to align production and inventory with real-time demand potential.

For example:

-

Vehicles registered between 2015–2018 are now in Peak Replacement Phase I — high demand for wear-and-tear parts.

-

Models from 2000–2007 are largely in End-of-Life — low to no replacement value.

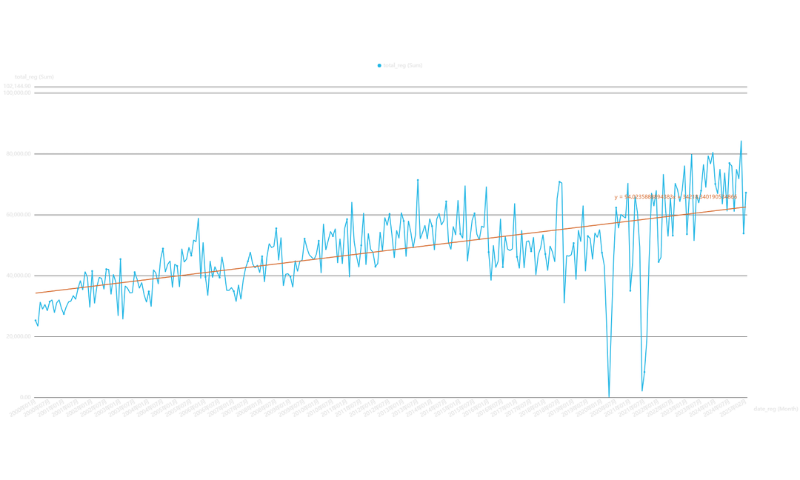

25 Years of Vehicle Intelligence:

From Records to Results

AutoSight 360 is built on over 14.6 million vehicle registration records spanning from January 2000 to February 2025. The dataset includes:

-

181 vehicle makers and 1,552 unique models

-

Vehicle types, colours, fuels, age groups, and regional distributions

-

Monthly trends tied to the parts replacement lifecycle

This enables not just descriptive reporting, but predictive foresight into which parts will move.

Turn Guesswork into Growth:

Forecast What Sells, Before It Sits

By translating registration data into lifecycle-based part demand, AutoSight 360 helps you:

Prioritise SKUs for vehicles in active replacement phases

Avoid overproduction and write-offs tied to obsolete models

Confidently invest in production, inventory, and distribution

AutoSight 360 helps you align your inventory with reality, not assumption. Know what’s on the road. Know what’s about to wear out. Know what sells.